No 6. Telephone Banking

With its invention telephone soon found many applications in different walks of life. One such industry which exploited this popular invention was banking. As telephony spread around the globe like wildfire, banks were quick to spot the powerful potential this technology represented. Soon banks were offering money transactions and account info via phone calls. This change brought the services of banks to our doorsteps. Telephone banking resulted in a sharp increase in customers along with improved customer services.

No 5. Credit Cards

Credit card can be called the currency of the 21st century.Dubbed as “Plastic money”, this technology has completely overshadowed paper money in many countries. Credit cards offer much greater security features and portability. A credit card allows its holder to buy goods and services based on the holder’s promise to pay for these goods and services. Credit cards are issued after an account has been approved by the credit provider, after which cardholders can use it to make purchases at merchants accepting that card. When a purchase is made, the credit card user agrees to pay the card issuer. The cardholder indicates consent to pay by signing a receipt with a record of the card details and indicating the amount to be paid or by entering a personal identification number (PIN). Also, many merchants now accept verbal authorizations via telephone and electronic authorization using the Internet, known as a ‘Card/Cardholder Not Present’ (CNP) transaction.

[youtube]http://www.youtube.com/watch?v=V0uFqsI1vy4&feature=PlayList&p=3503BD91664005B0&playnext_from=PL&playnext=1&index=1[/youtube]

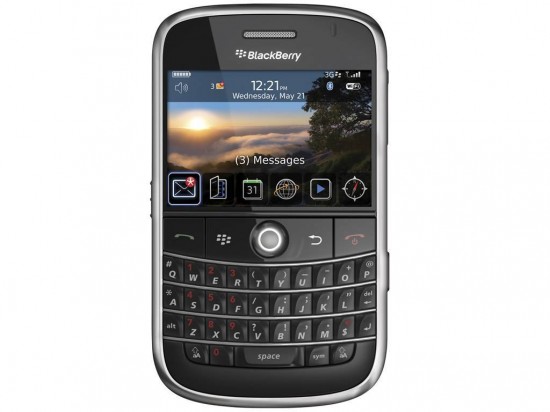

No 4. Smart Phones

The advent of smartphone brought the banking services at our fingertips. With a smartphone in pocket, your bank is on the move with you 24/7. This technology has revolutionized our banking practices. Transactions of staggering amounts are made with a few touches of a finger. This method is fool proof, time saving and reliable. A modern business man is incomplete without one of these little magic boxes. With the rapid advancements in smartphone technology, banking is bound to shift towards this consumer base.

[youtube]http://www.youtube.com/watch?v=chKaPV3PMVg[/youtube]

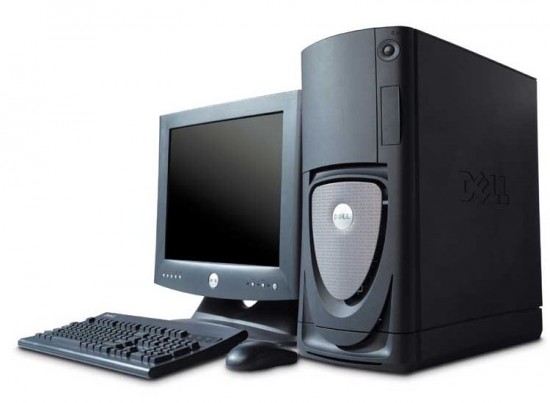

No 3. Computer

This wonder of an invention has reinvented banking along with countless other fields. Computers have amazingly increased the efficiency of banking operations. The sea of data which spread over numerous storerooms can now be saved in a single desktop. Also search and manipulation are also much easier to perform. Computers help tellers keep a record of all transactions for the day. When customers make deposits and withdrawals, cash checks, open checking accounts or apply for mortgage loans, a computer will store and track all of the information once a teller or bank employee keys it into the system. Computers are also the back bone of online banking. Without computers, it would be very hard for a bank to offer good customer service day in and day out.

[youtube]http://www.youtube.com/watch?v=XCUP-O9wN4M[/youtube]